Checklist for 401k Plan Best Practices. Items in this area of the checklist are typically provided by the 401 k plan administrator employer.

Infographic Plan Sponsor Plan Questionnaire Investment Solutions Group

401k plan costs have many elements.

. Checklist for 401k Plan Best Practices. Employers Tax Year End MonthDay _____ _____ If no date is entered your Tax Year End will be defaulted to December 31 2. Download Your Free Checklist.

Many retirement plan. The checklist is largely based on rooting out those particular failures. Many employers are realizing the need to offer benefits to retain and recruit top talent.

401K Audit Checklist. Plan sponsors are faced with a number of year-end deadlines related to new regulations or requirements impacting those plans in the coming year. Ad Learn the Benefits of Rolling Over Your Old 401k to a Fidelity IRA.

This Checklist is not a complete description of For Business Owners Use. Matching Contributions continued If the match is funded after the close of the year the plan can require participants to satisfy. 401k Design Sources of Information.

In what would be the largest change to the 401 k program SECURE 20 would require employers to automatically enroll all eligible workers into their 401 k plans at. 401k Plan Design Checklist Employee Fiduciary LLC. 401k Plan Review Checklist.

SIMPLE 401 k plans are similar to traditional 401 k plans but require less administration and fewer fees for the employer. Type of Business Organization Select one only Sole Proprietorship Partnership Limited Liability Company Nonprofit. Year-End 401k Plan Compliance Checklist.

Tracking a 401 k plan includes thorough reviews throughout the year with employers focused on fees and performance compliance and participant communication. Elective salary deferrals are excluded from the employees taxable income except for designated Roth deferrals. All plan requirements and should not be used as DO NO T SEND THIS WORKSHEET T O THE IRS a substitute for a complete plan review.

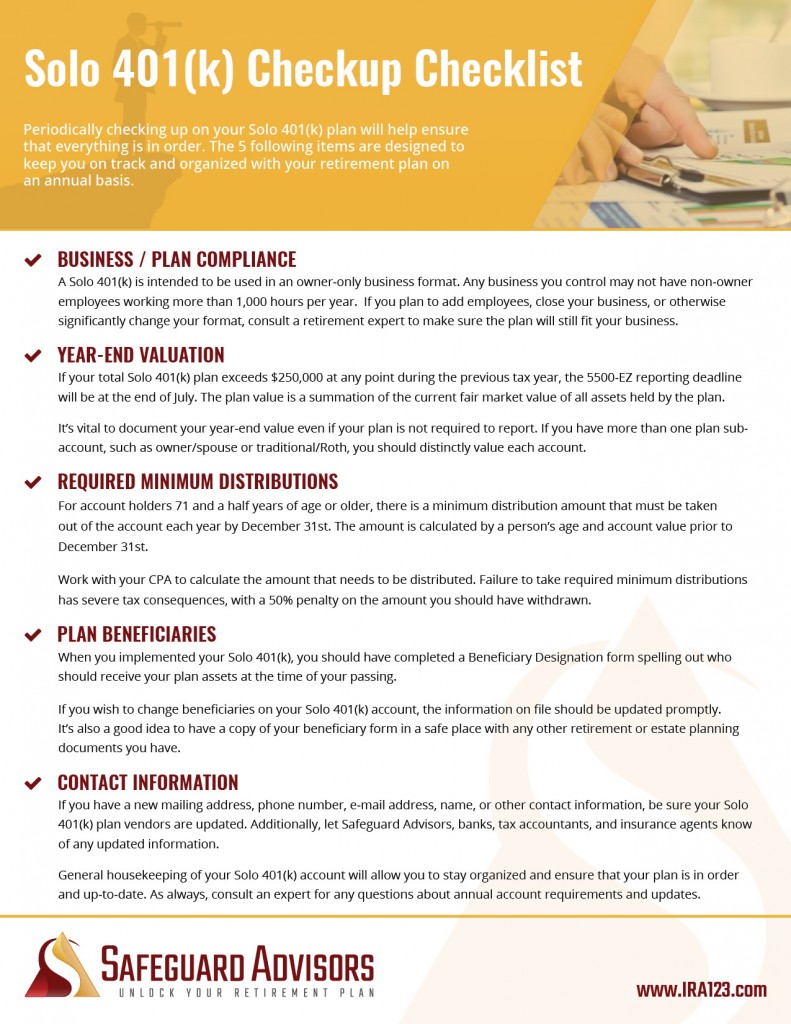

Romanowsky July 17 2015. 250 State Street Mobile AL 36603. A Solo 401 k is a retirement savings plan specifically designed for self-employed business owners and their spouses with no other eligible employees.

A Cross-Tested Plan is a retirement plan usually a profit-sharing. The most time sensitive item tends to be particularly for initial. Here are the most common required forms to set up a Self-Directed Solo 401k.

One of the most common benefits that we see used is the 401 k. Follow this Checklist. A brief checklist of 401k design considerations is provided.

This document is the primary document establishing the plan rules including eligibility criteria vesting employer matching and the like. Employers can contribute to employees accounts. Bulletproof Your 401k Plans.

401k Plan Design Checklist. Most 401k plans must file an annual return with the federal government. This is a shorter document explaining the basic points in the Plan Document above along with.

The IRSs 401 k Plan Checklist is a helpful tool to help assess whether your plan has fallen into the trap of the IRSs Top Ten Failures submitted for its Voluntary Correction Program. More Every year its important that you review the requirements for operating your 401k retirement plan. At Cook Martin Poulson we conduct 401k audits on a regular basis.

Is the maximum 401k deferral percentage consistent. Every year it is important that you review the requirements for operating your 401k retirement plan. Keeping your 401 k plan on course requires vigilance and a good plan sponsor navigates more than just the investment climate and daily maintenance of the plan.

A 401 k Fiduciary Checklist. Use this checklist to help ensure you are taking the necessary steps to keep your plan in compliance. Check the box if you can answer yes to the question.

Employee Fiduciary LLC 250 State Street Mobile AL 36603 877-401-5100 251-436-0800 F. Use this checklist to help you keep your plan in compliance with many of the important rules. There are many different styles of 401 k plans but all 401 ks are designed for employees to contribute a portion of their income for those contributions to be placed as investment.

401k Plan Design Checklist. The essence of a 401 k plan audit is understanding the documents and agreements the plan has in place and examining whether plan operations conform and comply with those documents and agreements. Deadlines and regulatory changes to make sure plan sponsors are ready for before 2022 rolls around by Brian Anderson.

Design aspects of funds entering the 401k contributions 1. While this list is by no means exhaustive employers that apply this checklist and are comfortable with their findings. An annual review of how you are operating your retirement plan can prove beneficial in avoiding the 12 most common retirement plan mistakes found by a Department Of Labor audit.

A 401 k is a feature of a qualified profit-sharing plan that allows employees to contribute a portion of their wages to individual accounts. Distributions including earnings are includible in taxable. 401k Plan Design Guide.

If your companys retirement plan meets the 401k audit requirements as set out by ERISA then you must hire a third party administrator TPA to carry out the audit. Whether for internal purposes or in preparation for an audit by the IRS or DOL employers who sponsor 401k plans may find it useful to review the best practices checklist below. Part I Plan Design Information 1.

How Much Does a 401k Audit Cost. 401k Plan Design QuestionnaireIf you are considering establishing a 401k plan or redesigning it and would like some suggestions complete our 401k Plan Design Questionnaire. Items to consider when outsourcing plan oversight responsibilities.

401 K Checklist How To Choose The Best 401 K Provider

Resources To Help You Manage Your 401k Independent 401k Advisors

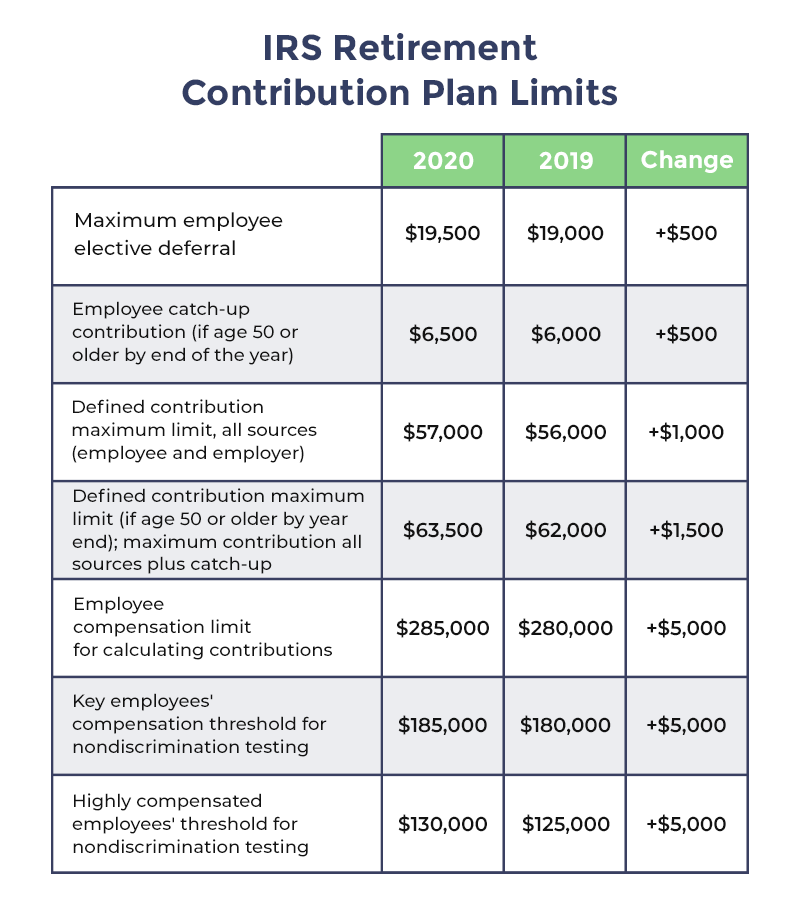

The Big List Of 401k Faqs For 2020 Workest

401 K Advisor Resources Pai Com

Improvement Opportunity Checklist For Dc Plan Sponsors 401k Plan Optimization Compliance Investment Partners

0 comments

Post a Comment